Not known Factual Statements About Insurance Quotes

Wiki Article

Little Known Facts About Insurance Expense.

Table of ContentsWhat Does Insurance Code Do?The smart Trick of Insurance Asia That Nobody is DiscussingThe smart Trick of Insurance Asia Awards That Nobody is Talking AboutInsurance Asia - TruthsSome Known Incorrect Statements About Insurance Asia

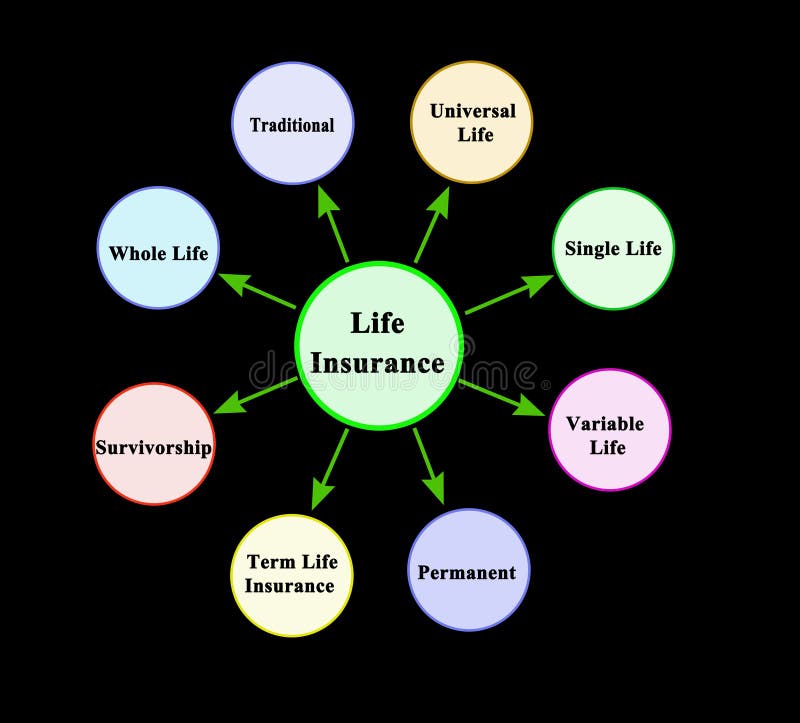

Various other types of life insurance policyGroup life insurance policy is commonly used by companies as component of the firm's workplace advantages. Costs are based on the group all at once, instead of each individual. Generally, companies supply fundamental insurance coverage absolutely free, with the choice to acquire extra life insurance if you require more coverage.Mortgage life insurance coverage covers the existing balance of your home mortgage and pays out to the loan provider, not your family, if you pass away. Second-to-die: Pays after both policyholders die. These policies can be utilized to cover estate tax obligations or the treatment of a reliant after both policyholders die. Often asked inquiries, What's the best kind of life insurance policy to get? The most effective life insurance policy policy for you boils down to your demands and budget. Which kinds of life insurance policy deal adaptable costs? With term life

insurance and whole life insurance, premiums normally are repaired, which implies you'll pay the exact same quantity every month. The insurance you require at every age differs. Tim Macpherson/Getty Images You require to acquire insurance policy to shield on your own, your family members, as well as your wealth. Insurance could conserve you hundreds of dollars in the event of an accident, disease, or calamity. Medical insurance and also car insurance policy are called for, while life insurance policy, home owners, tenants, and disability insurance policy are motivated. Begin absolutely free Insurance policy isn't the most awesome to think of, yet it's neededfor safeguarding yourself, your household, and also your riches. Accidents, disease, and calamities occur all the time. At worst, occasions like these can plunge you right into deep financial wreck if you do not have insurance coverage to draw on. Plus, as your life adjustments(state, you get a new work or have an infant)so must your protection.

Fascination About Insurance Agent Job Description

Listed below, we have actually described briefly which insurance policy coverage you should highly think about purchasing every stage of life. Keep in mind that while the policies listed below are prepared by age, of training course they aren't prepared in stone. Although several individuals probably have temporary special needs with their company, long-lasting disability insurance policy is the onethat lots of people require and do not have. When you are damaged or ill and also incapable to function, disability insurance policy offers you with a portion of your income. Once you leave the working globe around age 65, which is commonly completion of the longest plan you can purchase. The longer you wait to purchase a plan, the better the eventual expense.If somebody else depends on your income for their economic wellness, then you possibly need life insurance policy. The finest life insurance coverage policy for you depends on your spending plan as well as your financial objectives. Insurance policy you need in your 30s , Homeowners insurance coverage, Homeowners insurance coverage is not called for by state law.

The smart Trick of Insurance And Investment That Nobody is Discussing

-If, however, you survive the term, no cash will certainly be paid to you or your family. -Your family members receives a specific sum of money after your fatality.-They will certainly also be qualified to a bonus that commonly accumulates on such amount. Endowment Policy -Like a term policy, it is additionally valid for a certain period.- A lump-sum amount will be paid to your household in the event of your death. Money-back Policy- A certain percentage of the amount ensured will certainly find out here be paid to you periodically throughout the term as survival advantage.-After the expiration of the term, you get the balance amount as maturity earnings. -Your family obtains the entire amount ensured in instance of death during the policy duration. The quantity you pay as costs can be this content subtracted from your overall gross income. This is subject to a maximum of Rs 1. 5 lakh, under Area 80C of the Revenue Tax Act. The premium amount used for tax deduction ought to not go beyond 10 %of the sum assured.What is General Insurance coverage? A general insurance is an agreement that supplies economic settlement on any type of loss aside from death. You could, therefore, go on and surprise your companion with a ruby ring without fretting about the treatment prices. The damage in your cars and truck didn't trigger a dent in your pocket. Your electric motor insurance policy' own damage cover spent for your automobile's damages brought on by the crash.

The smart Trick of Insurance Meaning That Nobody is Discussing

Your description health and wellness insurance coverage took treatment of your therapy costs. As you can see, General Insurance coverage can be the response to life's different troubles. Pre-existing diseases cover: Your wellness insurance coverage takes care of the therapy of illness you may have before buying the health insurance coverage policy.Two-wheeler Insurance, This is your bike's guardian angel. As with automobile insurance coverage, what the insurer will pay depends on the type of insurance policy and what it covers. Third Party Insurance Comprehensive Auto Insurance, Makes up for the problems caused created another an additionalPerson their vehicle automobile a third-party propertyResidential or commercial property

Report this wiki page